Fers retirement calculator online

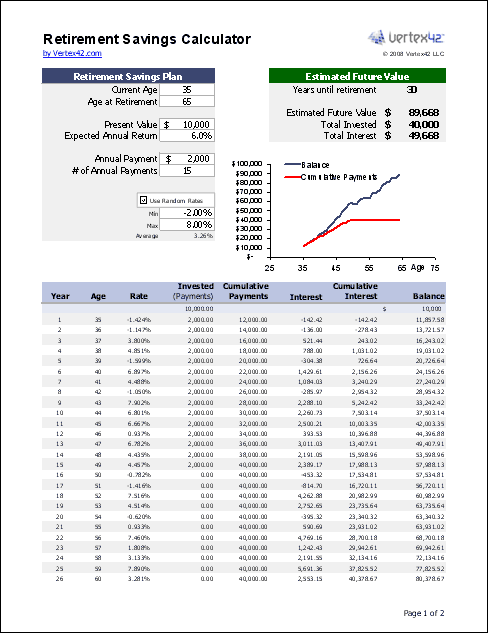

Information for New Annuitants. We assume that the contribution limits for your retirement accounts increase with inflation.

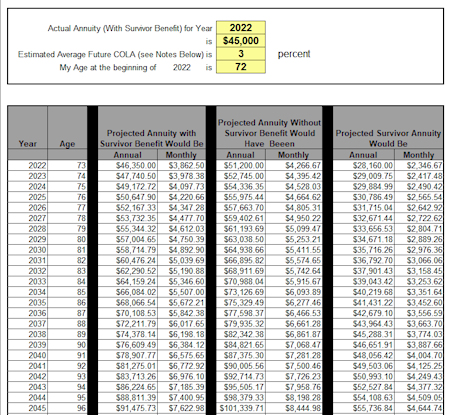

Projected Annuity Calculator Csrs Fers

We assume you will live to 95.

. FERS Disability Computation if. If you are CSRS Offset social security benefits may be subject to CSRS Offset. Loan Payoff Calculator.

SF 3102 Designation of BeneficiaryFederal Employees Retirement System. You have 25 years of creditable service. They are employees who are automatically covered by the Federal Employees Retirement System FERS Civil Service Retirement System CSRS Offset and those who elected to transfer to the FERS before January 1 1988 or during the belated transfer period which ended June 30 1988.

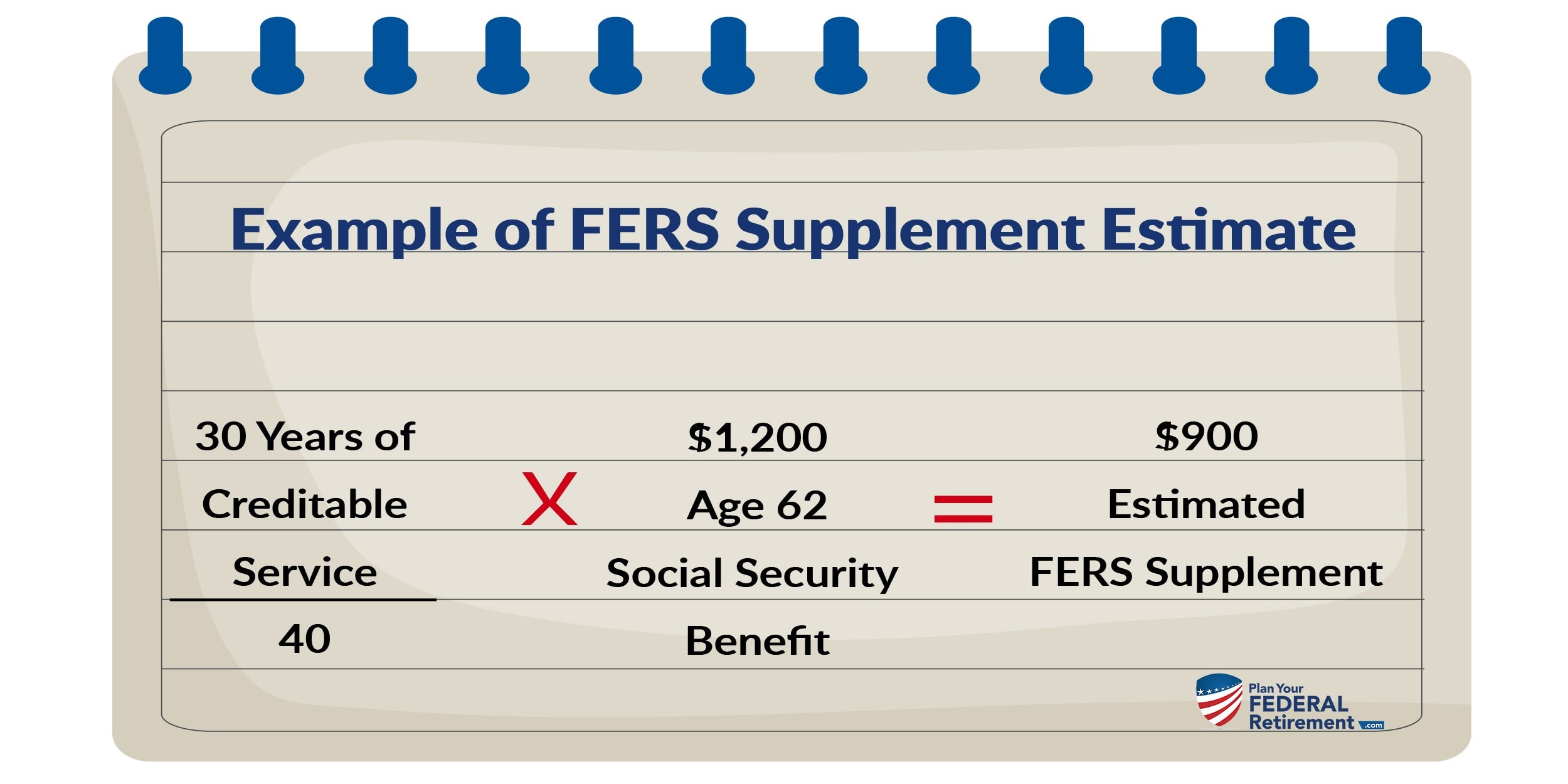

Use the Social Security Benefit calculator to calculate this input. OPM works with your Agencys personnel and payroll office to process your annuity claim. FERS Deferred Retirement is when you separate from service before you were eligible for immediate retirement either regular FERS retirement MRA30 6020 625 or FERS MRA10 Retirement.

To do a FERS Deferred Retirement you must. The Federal Employees Retirement System or FERS is the retirement plan for all US. Employees covered will retire with payments from a FERS Basic Benefit Plan Social Security and the Thrift Savings Plan TSP.

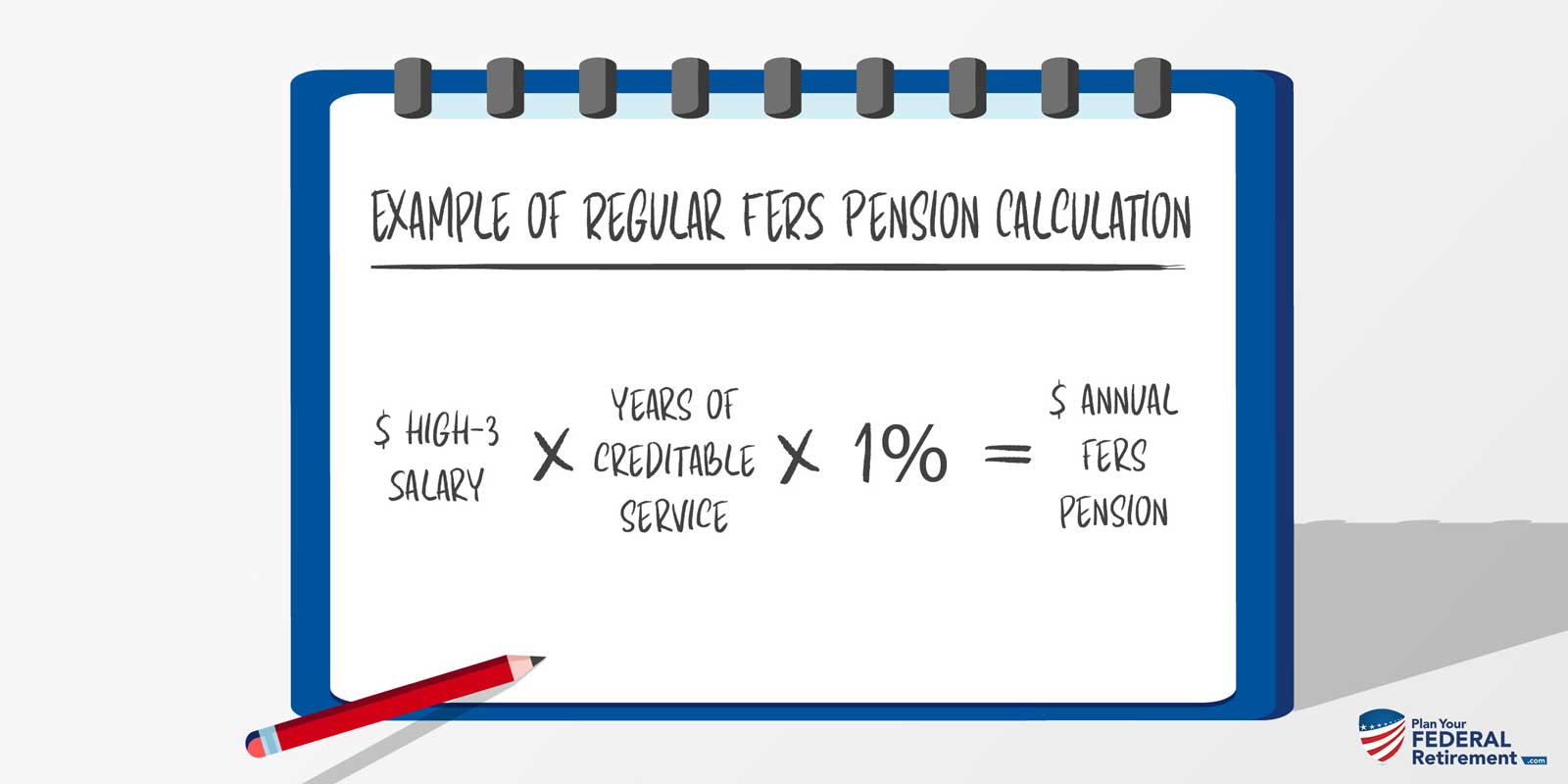

For easy numbers lets say your High-3 Salary is 100000. Leg 1 Your Basic FERS Pension. Retirement System designation forms for any money in the retirement fund remaining upon your death and any unpaid annuity.

If you are younger than age 62 your pension multiplier would be 1. FERS retirees can retire at age 55 while employees born between 1953 and 1969 must wait until age 57. Sometimes people will call your FERS pension a FERS annuity.

Taxes can be significant in retirement. Lease Calculator Car. An annuity from TSP or annuities from insurance companies were going to be using the term pension when we talk about your FERS retirement.

Congress created the Federal Retirement Employee Retirement System FERS FERS in 1986 and on January 1 1987 it became effective. Some employees are exempt from the Government Pension Offset. Even OPM calls it an annuity.

Have at least 5 years of creditable civilian service before you separate. FERS BASIC BENEFIT CALCULATION. OPM Retirement Facts Brochure.

Lets go over the basics of FERS Deferred Retirement and FERS Postponed Retirement Basics of FERS Deferred Retirement. But to avoid confusion with other annuities ex. Rent or Buy Calculator Home.

We automatically distribute your savings optimally among different retirement accounts. In addition you must have served in a position subject to CSRS coverage for one of the last two years before your retirement. Eligibility is based on your age and the number of years of creditable service and any other special requirements.

If you began working for the federal government from. Regardless of the type of retirement there are actions your personnel office must take in order to process your retirement claimYou can help reduce delays in processing by submitting your application in advance and by making sure your Official Personnel Folder OPF is complete. It is a retirement plan that provides future benefits from three different sources.

You can use this website if you receive benefits as an annuitant or survivor under the Civil Service. How Quickly Can You Repay Your Loan. We stop the analysis there regardless of your spouses age.

The Office of Personnel Management provides special access for federal retirees to manage their annuity payment information federal and state tax withholding tax forms and other benefits at Retirement Services Online SOL at wwwservicesonlineopmgov. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. Lets take an example.

In 1984 the federal government introduced a second retirement system known as the Federal Employees Retirement System or FERS. FERS disability benefits are computed in different ways depending on the annuitants age and amount of service at retirement. Providing a Survivor Benefit for your Former Spouse if you get divorced after.

It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees. Hopefully youll be able to find the right plan for you. Types of Retirement Learn about the age service requirements and considerations affecting the various types of retirement.

Deferred If you are a former Federal employee who was covered by the Federal Employees Retirement System FERS you may be eligible for a deferred annuity at age 62 or the Minimum Retirement Age MRA. AND you must leave your contributions in the FERS system. Thrift Savings Plan TSP.

Code and effective January 1 1987. Get the most out of your federal retirement benefits by taking advantage of the FERS resources created by Micah Shilanski CFP and the team of independent financial advisors at Shilanski Associates Inc. Taxes Federal Tax Calculator and Guide.

The FERS basic annuity formula is actually pretty simple and is based on your salary and years of service. Federal Employees Retirement System FERS The Federal Employees Retirement System FERS was established by Public Law 99-335 in Chapter 84 of title 5 US. And if you retire at age 62 or older with 20 years of service you get a slight bonus 11 multiplier vs.

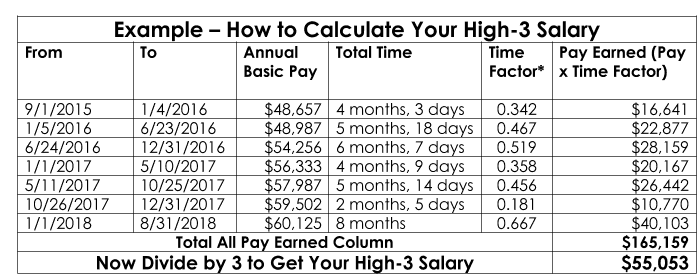

FERS Basic Annuity High-3 Salary x Years of Service x 1. It is important to keep your tax returns organized and in a safe location for future reference. Heres a breakdown of each.

Join the thousands of federal employees who trust us to guide them in their retirement planning journey because of our unique perspective of how your FERS benefits. The Federal Employees Retirement System FERS is a three-tiered system that includes. Employees under FERS receive retirement benefits from three sources.

In addition FERS disability retirement benefits are recomputed after the first twelve months and again at age 62 if the annuitant is under age 62 at the time of disability retirement. There are five categories of benefits under the Civil Service Retirement System CSRS. SF 2808 Designation of BeneficiaryCivil Service Retirement System.

FERS CSRS Retirement Calculator Beta version The initial version of this calculator has been used for several years to help government employees predict whether their current and future levels of saving will provide sufficient income at the desired retirement age. The basic benefit. Basically you leave federal service now.

If you separate from service with at least 10 years of service and you have at least reached your MRA you can do a FERS Postponed Retirementwhich. It was established by Congress in the Federal Employees Retirement System Act of 1986 and offers the same types of savings and tax benefits that many private corporations offer their employees. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve.

Use our FERS Retirement Calculator and CSRS Retirement Calculator to estimate your monthly annuity and calculate what your federal tax burden will be before you leave by using OPMs tax calculator. While both of these programs have some similarities the two have very different rules. Theres a lot to know about FERS Retirement Calculator.

Your Retirement Estimate And Payment Options Youtube

Federal Retirement Calculators Federal Benefits Information Center

Fers Supplement Plan Your Federal Retirement

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

Fers Calculator Retirement Benefits Instituteretirement Benefits Institute

Fers Retirement Calculator Youtube

Retirement Calculator With Pension Flash Sales Save 31 Www Assumptionsbooks Com

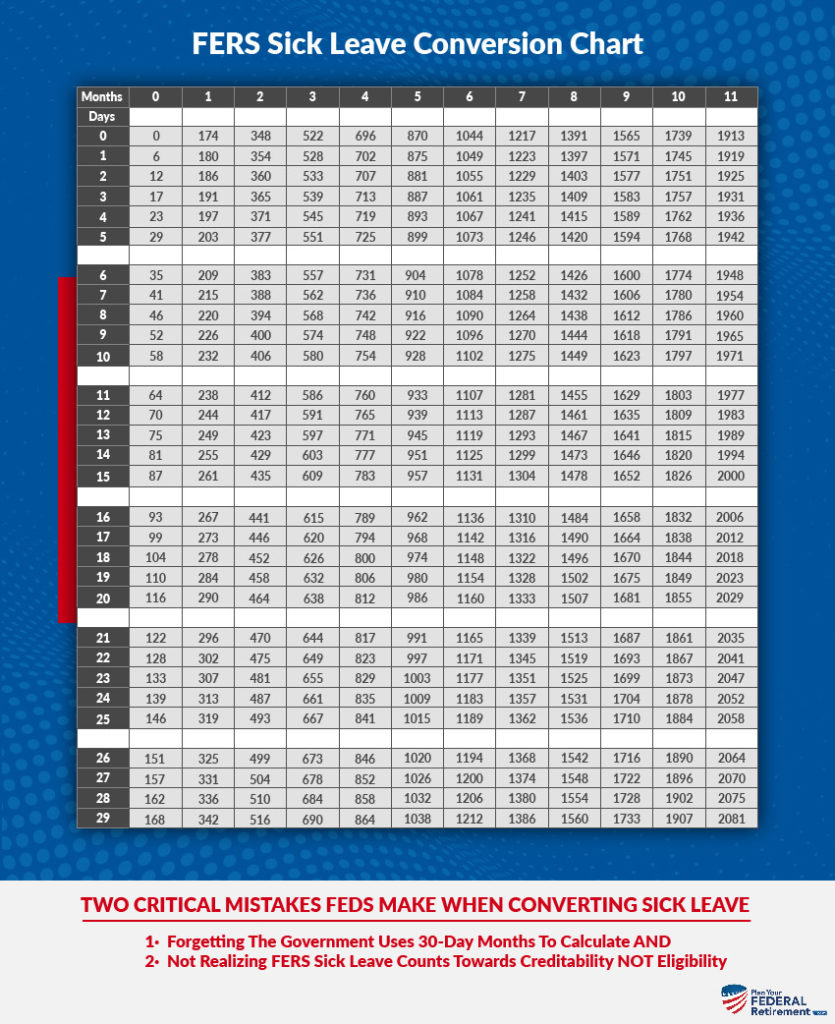

Calculating Service Credit For Sick Leave At Retirement

This Is What Your Retirement Savings Needs To Be At Every Age Saving For Retirement Investing For Retirement Retirement Savings Plan

How To Calculate Your High 3 Salary Plan Your Federal Retirement

Federal Retirement Calculator Fers Csrs My Federal Retirement

Retirement Calculator With Pension Flash Sales Save 31 Www Assumptionsbooks Com

Financial Tips For Federal Employees Fedsmith Com

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Usda Aphis How To Run A Retirement Estimate Using Grb Platform

Fers Retirement And Sick Leave Plan Your Federal Retirement